3 Stocks New Investors Should Consider

Updated: November 3, 2022

If you’re just starting out in the stock market, it can be tough to know where to begin. That’s why we’ve put together a list of three stocks that are perfect for new investors.

These stocks have all performed well in 2022 even though the entire market has been down, and they have the potential to generate significant returns in 2023 and beyond. So if you’re looking for a place to start, these stocks are a great option!

*Note: Even if the stock price is above $100 you can still invest! Consider downloading an app that allows you to invest in fractional shares. This allows you to invest based on your budget and not the stock’s price. (My favorite investing app is Public and with this link you can receive a free stock.)

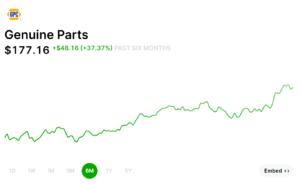

#1 Genuine Parts Company (GPC)

At the time of writing Genuine Parts Company is up 26% in 2022, compared to the rest of the stock market which is down -22% during the same time frame. What makes GPC special however is this: The company has paid an increasing dividend 66 years in-a-row! That means that for over half a century, GPC has continued to reward shareholders with ever-increasing cash payments. This makes it an ideal stock for new investors who are looking for stability and income in their portfolio.

If you are worried about a recession in 2023, this company (as well as #2 on our list) should still perform well. When the economy slows down people tend to hold on to their cars more and invest more on car repairs making GPC one of the better stocks during recessions.

#2 AutoZone (AZO)

AutoZone is another great stock for new investors. Similar to GPC, AutoZone will benefit from people holding on to their cars longer and making repairs rather than buying a new car during an economic downturn. Additionally, the stock is up about 18% at the time of writing but over the last 5 years the stock price has soared more than 305% making it a great long-term investment as well.

#3 Humana (HUM)

Insurance companies have been one of the best sectors to invest in during times of inflation and uncertainty. Humana is no different and has outperformed the market in 2020 and 2021. The stock is up about 20% so far this year.

While stocks like GPC and AZO will do well in a recession, Humana will continue to shine even if the economy picks back up. That is because as people live longer and healthcare becomes more expensive, insurance companies will continue to benefit.

So there you have it! Three stocks that are perfect for new investors. Whether you’re looking for income, stability, or long-term growth, these stocks have it all.

What to learn more about how you can start investing? Check out my FREE masterclass: How to Create Your Six Figure Investing Plan (from scratch…). In the class I will show you how to protect yourself when the market falls, how to find great stocks, and give you a simple investing plan that you can follow regardless of your experience level.

To sign up for the masterclass, click here.

DISCLAIMER: This information is intended for the purposes of education only. This content is not a solicitation to buy or engage in any securities transaction. BuildingBread nor Kevin L. Matthews II is responsible for any losses, financial or otherwise, as a result of engaging in any securities transaction. All content is that of the author and does not represent any company or sponsor.